Making green dollars and sense - unlocking sustainable finance for your business

By Gerri Ward

Late-last year, we were fortunate to be involved with the sixth annual KangaNews-Westpac New Zealand Sustainable Finance Summit, where a bunch of very clever finance people, commentators, leaders, and directors got together to discuss financing the transition to decarbonisation.

What really struck us about the conversations on the day was the incontrovertible fact that sustainable finance really is the thing that’s going to mobilise real change – globally and locally – and is, somewhat reassuringly, gaining its own momentum outside of geopolitical insecurity and declining political will.

The primary catalyst for this change is the increasing awareness that sustainable investments can deliver competitive returns while also addressing ESG-related (environmental, social, and governance) risks. Investors are seeking investments that not only generate financial gains but also support environmental and societal objectives. This shift in priorities has led to a notable rise in the allocation of capital towards ESG-oriented assets.

Those leading the charge on sustainability-linked investing are doing so because they recognise that a shift to a low-carbon, more sustainable economy is essential for the long-term health of capital markets. As one of the panellists at the Summit said, “Our primary consideration is having access to capital. Having the green label is only going to help. It is hard to define how much, but this is why it is essential for us to keep rolling out our strategy of decarbonisation. The green label totally aligns with our strategy, so it all links together very nicely.’

New Zealand Green Investment Finance Limited (NZGIF) is a Crown-owned green investment bank that has been established to facilitate and accelerate investment that enables decarbonisation in New Zealand. Last year, the Government announced a sustainable finance strategy to help accelerate New Zealand's appeal and competitiveness for investors who have a sustainable finance focus. For instance, NZGIF has led a debt issuance of $365m (NZD) for medium- to long-term debt to solar providers, as well as a tripartite agreement between Far North Solar Farm, Transpower, and NZGIF that facilitates the uptake of new renewable energy generation.

As Chapman Tripp’s very excellent review report ‘Investing for Impact’ found last year, the rise in more tailored and targeted sustainable finance products speaks to the New Zealand market’s increasing maturity, the importance of small and medium enterprises (SMEs) to New Zealand’s economy, and the role of banks and other lenders in supporting a transition to economic sustainability.

Year-on-year, the global sustainable finance market has experienced significant expansion and is expected to continue on an upwards trajectory. According to Bloomberg, ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the projected $140.5 trillion in total global assets under management.

There is no doubt that this pace of change is being led by far bigger institutions, far further up the chain. As is to be expected, the likes of BlackRock, Goldman Sachs, and Morgan Stanley are investing many trillions of dollars into sustainable finance instruments that will grease the wheels of the decarbonisation transition. But they’re not doing it out of altruism. As Larry Fink himself said recently, ‘We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients.’ The banks who are leading the charge on sustainably-linked lending and green finance in New Zealand are reading the writing on the wall: green-up, or risk missing out on value-creation and long-term profitability. As another panellist at the Westpac Summit found: ‘About 95% of queries about our sustainable finance programme have been from offshore investors. But while there is a lot more demand offshore, there is a lot of potential in New Zealand. We have more direct engagement with our domestic investors and can work more collaboratively to structure products they are comfortable with.’

Interestingly, however, we at Oxygen find that we’re having conversations more from the bottom-up: customers are talking to their banks and advisers about sustainable financing options as a demonstration of their commitment; along with as an instrument to connect their financing options with their broader ESG strategy. And as we see further downward pressure on interest rates, we will likely see a rise in the former, with the latter being seen more as an additional incentive in demonstrating the credibility of the agreed ESG-related key performance indicators (KPIs) within the organisational strategy.

Our advice, predictably, is to start first with your overall enterprise strategy, make sure you know how your ESG strategy is embedded within that, and then talk to your bank about sustainable lending options. Not only is this going to make life easier in the long run, it stands up better to the sniff test for investors who are looking for integrity and demonstrable commitment.

What are sustainable finance instruments?

Put simply, sustainable finance is a form of debt funding for investments that are tied to ESG initiatives. Sustainable lending typically encompasses two main types of financial products: green bonds and loans; where the funds raised must be allocated to ESG-oriented projects, and sustainability-linked loans (SLL), which are term loans that require the borrower to enhance their overall sustainability performance, with KPIs chosen from various available options.

The targets for green loans and the KPIs for SLLs cover areas such as renewable energy, energy efficiency, pollution reduction, sustainable resource management, biodiversity preservation, clean transportation, water conservation, climate change adaptation, eco-efficiency, the circular economy, and green building initiatives.

1. Green bonds

The most common type of sustainable financing is in the form of a green bond. Green bonds are fixed-income instruments where the proceeds are exclusively applied towards new and existing green projects. These projects need to have clear environmental benefits such as renewable energy, green buildings, wastewater management, energy efficiency, and public transport. Ultimately, the key motivations for issuers to issue with a green label is that green bonds can help attract new investors while highlighting the sustainability ambitions of the issuer.

In October 2024, Top Energy (the Far North electricity generator and distributor) converted all its bank facilities into green loans. Eligible assets for the green loans include renewable geothermal generation plants, electrical grids, and storage assets.

Under the green loan terms, their lender (ICBC New Zealand) provides an interest discount contingent on Top Energy maintaining eligible assets equal to its total green loan limit. Top Energy will demonstrate ongoing eligibility through annual update reports.

2. Social Impact Bonds

A social impact bond is a contract with an organisation that pays for better social outcomes. It uses private investors' money, instead of public money, to pay a provider to deliver a service. If an agreed set of outcomes are reached, the government pays the investor a return.

In 2022, the World Bank’s International Finance Corporation issued its first New Zealand dollar-denominated social bond to support underserved communities in developing countries, including women entrepreneurs and low-income households in need of access to essential services. The seven-year fixed-rate bond raised $300 million to support the development of the ESG bond market in New Zealand following the inaugural New Zealand government green bond issued in the same month.

Genesis Youth Trust was one of the organisations that issued a social bond in 2017 to reduce youth offending. The Trust found that the performance-driven targets pushed them to constantly improve their service delivery, and enabled them to work to reduce reoffending rates by 30%.

3. Sustainability Bonds

Sustainability Bonds are fixed-income financial instruments (bonds) where the proceeds will be exclusively used to finance or re-finance a combination of Green and Social Projects and which are aligned with the four core components of the International Capital Market Association (ICMA) Green Bonds Principles and Social Bonds principles.

The main difference among green, social and sustainability bonds, is in the categories for the allocation of proceeds; sustainability bonds needing to combine both social and green categories.

4. Sustainability-Linked Loans

A Sustainability-Linked Loan (‘SLL’) is a loan whereby a financial incentive is linked to the sustainability performance of the borrower. Sustainability-linked loans refer to various loan instruments or contingent facilities (such as bonding lines, guarantee lines, or letters of credit) that provide incentives for the borrower to meet specific, predetermined sustainability performance goals. The borrower’s sustainability progress is evaluated using sustainability performance targets (SPTs), which include key performance indicators, external ratings, and/or other comparable metrics, and are designed to track improvements in the borrower’s sustainability profile. Importantly, the borrower needs to demonstrate, against the Loan Syndications and Trading Association’s (LSTA) Sustainability-Linked Loan Principles (SLLP), which key performance indicators and sustainability targets should be set, and detail expectations with regard to benchmarking and disclosures. Usually, the borrower uses the assured SLL to gain financing from more than one financier. Queenstown Airport, for instance, executed SLLs with all four banking partners: Westpac NZ, BNZ, ASB, and Bank of China. BNZ and Westpac NZ acted as Joint Sustainability Coordinators on the transaction.

Some recent examples of SLLs in Aotearoa New Zealand include:

Pamu’s $225 million SLL last year with ASB, Westpac, and ANZ, that includes terms that help to ensure farming activities contribute positively to the environment, people and communities. This includes maintaining best practices in employment and animal welfare, as well as striving for positive environmental outcomes.

Auckland Council converted an existing $200 million standby facility into its first sustainability linked loan in 2022. The Council needs to meet three different sustainability performance targets (SPTs) on an annual basis, centered on fleet transition, emissions reduction, and diverse procurement, with tools in place to measure progress and success and ensure compliance. The loan and derivative, both established with ANZ, financially incentivise the council to meet sustainability performance targets, as higher rates of interest will be applied to the loan and derivative if they fail to reach those targets. The Council’s subsequent 2024 Sustainable Finance Framework supports the council to raise sustainable debt via the execution and issuance of a range of sustainable debt instruments, namely: green financing transactions in the form of green bonds or green loans where an amount equal to the net proceeds of the Green Debt are allocated to finance or refinance eligible assets; and sustainability-linked transactions in the form of sustainability-linked bonds, loans or derivatives. As the Council says: ‘The potential impact of individual SLLs and SLDs is relatively small in an economic sense but it will become quite meaningful when we start aggregating all our facilities and derivatives into sustainability-linked format.’

Auckland Construction company Jalcon Homes agreed a sustainability-linked loan with Kiwibank last year. With support from Oxygen Consulting (Kiwibank’s preferred SLL advisory provider), Jalcon created a sustainability strategy that was co-funded by Kiwibank. The strategy outlines the changes and initiatives Jalcon will undertake to become more sustainable. Its SLL will be linked to Jalcon achieving the targets and commitments set in its sustainability strategy.

How they work

Source: Sustainalytics

Oxygen Consulting can provide this expert, independent verification to assist organisations with the credibility and robustness of sustainable lending transactions. Our Second Party Opinion assesses whether an organisation’s sustainability key performance indicators (KPIs) and/or Sustainability Performance Targets (SPTs) linked to its loan are sufficiently ambitious, credible, and aligned with the five core components of the Sustainability-Linked Loan Principles (SLLP). We also work at the customer end, helping organisations to put in place the strategies and activities they can include in their SLLs. We can also provide independent assurance over GHG emissions; which is almost always one of the selected KPIs in a SLL.

The New Zealand market

The Centre for Sustainable Finance Toitū Tahua and KPMG released a review report in 2022 on the global and local growth of the sustainable finance market. The review report (which, it should be noted, is now a couple of years out of date) evaluated the local sustainable finance market, and summarised its total value exceeded $13 billion, and saw an encouraging increase in both the quantity and diversity of products and actors.

As the review report found, our banks are critical drivers of change. In 2022, each of the five major banks in New Zealand reported on sustainable finance activity. The (self-reported) total of the sustainable funding or financing activity for the 2022 financial year (FY22) was $16.5 billion, a substantial increase when compared to the $9.05 billion reported in the 2021 financial year (FY21).

In addition to the increase of sustainable financing for institutional customers, banks are at the forefront of main-streaming sustainable finance by creating products to suit the needs of either small and medium-sized enterprises (SMEs) or retail borrowers. A handy summary of these is below:

Source: Centre for Sustainable Finance Toitū Tahua and KPMG 2022 review report

What’s out there

We’ve worked with many banks in New Zealand that offer sustainable lending options, such as green loans, sustainable home loans, and financing for environmentally friendly or socially responsible projects. If you’re in the market for such an instrument, here’s a brief, unverified, consolidated summary of what the major banks offer:

1. ANZ

ANZ New Zealand has a Sustainable Finance Framework for supporting businesses with low-carbon or environmental projects, such as renewable energy investments or waste reduction initiatives.

ANZ New Zealand’s Sustainable Finance product offering for institutional customers currently includes:

Green, Social and Sustainability Loans

Green, Social and Sustainability Bonds

Sustainability-Linked Loans

Sustainability-Linked Bonds

Sustainability-Linked Derivatives

Sustainability-Linked Guarantees

Guarantees/Letters of Credit issued in respect of Green Assets/Projects

Sustainable Supply Chain Finance

To qualify for an ANZ Green Loan, you must meet ANZ’s Business Green Loan Eligibility Criteria by demonstrating clear environmental benefits from the assets or projects your business invests in. The green loans are available per entity subject to the ANZ Business Green Loan floating interest rate up to $3 million in total.

ANZ New Zealand also offers these products to support retail customers in Aotearoa New Zealand:

2. ASB Bank

Corporate and Business Bank customers

ASB’s Sustainable Finance Framework was published in September last year, which overviews their SLL, Green Loan and Social Loan offering. ASB also offer a Sustainable Transition Loan which is available to ASB customers. This loan is designed to support those who are at an early stage in their sustainability journey, where customers commit to developing a sustainability strategy within 12 months of their loan drawdown that has the following attributes in the strategy:

Be connected to the organisation’s vision and mission, and to its business objectives

Identify and address the environmental, social and governance impacts that are most material (relevant) for the business

Include a programme of action with ambitious and meaningful sustainability performance targets

Outline clear responsibilities and accountabilities

Address climate change impact, including:

An assessment of material climate risks and opportunities (physical and transition risks)

Plans to measure and reduce greenhouse gas (GHG) emissions in line with international frameworks.

Residential Customers

ASB’s Better Homes Top Up enables existing home loan customers to receive a special offer 1% fixed rate for 3 years, for a combination of eligible home improvements, or purchase of an electric or hybrid vehicle, up to $80,000.

3. BNZ

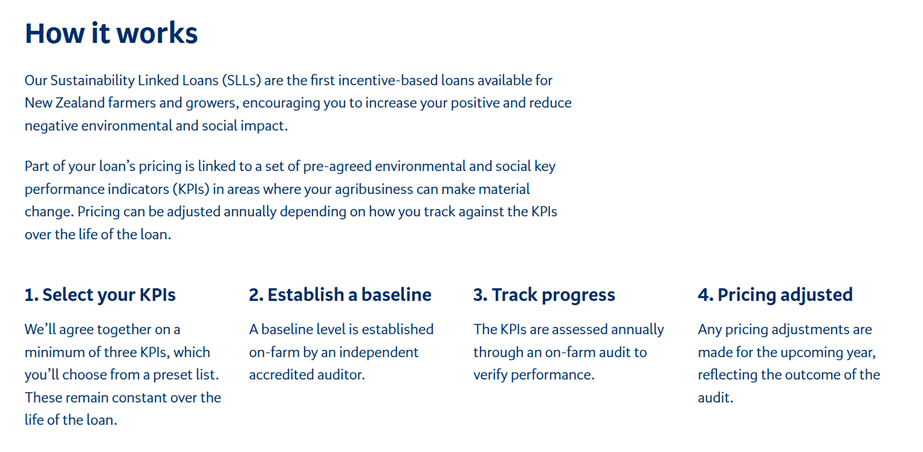

BNZ’s Sustainability Linked Loans (see below) are incentive-based loans available for Aotearoa New Zealand farmers and growers, encouraging borrowers to increase positive and reduce negative environmental and social impact.

BNZ’s SLLs are available to agribusinesses that meet BNZ’s baseline lending and credit criteria and can demonstrate good existing on-farm sustainability practices. Every SLL must include a Greenhouse Gas emissions reduction KPI. Other KPIs could include improvements in biodiversity, animal health, water quality, and staff development.

An on-farm accredited auditor assesses the borrower’s baseline KPI position in order to commence the SLL. The KPIs are then annually audited over the life of the loan, with annual progress reflected in pricing adjustments to the cost of lending each year.

3. Kiwibank

Kiwibank's Sustainable Business Loans are designed to help New Zealand businesses fund projects that positively impact the environment or contribute to social sustainability. These loans offer competitive rates, flexible terms, and a tailored approach to suit businesses aiming to enhance their sustainability practices. They support initiatives such as sustainable buildings, energy efficiency and renewable energy, sustainable transport and equipment, water and waste reduction, sustainable industries and conversation and land use change, encouraging businesses to invest in long-term sustainable growth while making a positive difference.

If you're a B Corp certified business, you can get access to preferential rates on Kiwibank business loans. For existing business loans, preferential pricing will be worked through based on your borrowing needs and timing.

4. Westpac New Zealand

Westpac’s sustainable finance instruments are aimed at helping their institutional and retail customers to meet their own sustainability goals. They offer:

Strategic support to customers looking to improve sustainability ambition

Connecting finance to improving sustainability

Structuring Green, Transition, Social, Sustainability loans, bonds and deposits

Tailoring solutions to support the transition to a more sustainable, resilient and inclusive future

Some of Westpac’s recent sustainable finance transactions include:

Contact Energy – In 2020, Contact Energy secured a $50 million SLL with Westpac NZ. This four-year loan agreement incentivised Contact Energy to enhance its performance in areas such as corporate governance, stakeholder engagement, and environmental sustainability.

Genesis Energy – In 2021, Genesis Energy secured a $100 million SLL with Westpac NZ. This three-year loan incentivised Genesis to meet specific sustainability targets, including reductions across all scopes of emissions and increased renewable energy generation.

The Warehouse Group – In 2021, The Warehouse Group secured a $70 million SLL with Westpac NZ. This two-year extendable loan financially incentivises the company to achieve sustainability targets over a four-year period, including sustainable packaging, carbon emissions reduction, ethical sourcing, and gender diversity.

The 2023 New Zealand Local Government Funding Agency – Sustainable Financing Bond gave investors an opportunity to support councils to reduce emissions and fund sustainable assets.

Reserve Bank of New Zealand (RBNZ) - Green Bonds

While not a bank offering retail lending, the Reserve Bank plays a key role in regulating and supporting the development of green bonds in Aotearoa New Zealand. These bonds can be used by businesses to finance sustainable projects.

The New Zealand Local Government Funding Agency (LGFA)

The LGFA has created a Sustainable Financing Bond Framework to support councils and council-controlled organisations (CCOs) in funding sustainable projects and reducing greenhouse gas emissions. This framework enables LGFA to issue bonds tied to Sustainable Loans on its balance sheet, offering investors a chance to support sustainability goals. The loans, part of LGFA’s Green, Social, and Sustainability Lending Programme and Climate Action Loans Programme, will be allocated to eligible projects. The Framework outlines the process for issuing and managing these bonds linked to the loans that meet specified sustainability criteria.

General Sustainable Lending Initiatives

In addition to individual bank offerings, many Aotearoa New Zealand banks are members of Aotearoa New Zealand's Sustainable Finance Forum (SFF) and adhere to international sustainable finance standards. These include the Green Loan Principles and the Sustainable Finance Forum, designed to encourage responsible lending and investment.

As always, if you're looking for a specific product, it's always a good idea to directly contact these banks or visit their websites for the most current information and eligibility criteria.

A note on Sustainable Finance Taxonomies

A sustainable finance taxonomy is a standardised framework for classifying economic activities according to their environmental performance. Taxonomies are designed to define which economic activities are aligned to a sustainable, low-emissions future, with a view to directing investment to the activities required for the transition.

In 2023-2024, the Centre for Sustainable Finance: Toitū Tahua (CSF) convened an Independent Technical Advisory Group (ITAG) to develop key design recommendation for the Aotearoa New Zealand Sustainable Finance Taxonomy (NZ Taxonomy). The resulting recommendations report, covering ten key topics, was presented to the Minister for Climate Change and made public in July 2024.

Based on these recommendations CSF, in partnership with the New Zealand Government, began work in late-2024 to develop a NZ Taxonomy, beginning with climate mitigation, adaptation and resilience criteria for the agriculture and forestry sectors.

The introduction of a Taxonomy in Aotearoa New Zealand may require market participants to describe the extent to which relevant economic activities are sustainable.

A taxonomy has the potential to reduce market uncertainty about the circumstances in which particular labels may be attached to particular financial products. This could reduce both greenwashing risks, and the risk of organisations staying silent on sustainability-related matters to avoid being accused of making misleading statements (known as “greenhushing”). In turn, this could allow the development of new financial products, such as Kiwisaver products that align (and can be marketed as aligning) with taxonomy criteria.

Additionally, sustainable finance products such as green bonds and sustainability linked loans have, to date, tended to be available primarily to larger corporates rather than broadly across the market. Again, some stakeholders have suggested that the introduction of a Taxonomy in New Zealand could expand the sustainable finance market by increasing clarity and reducing complexity for lenders and borrowers.

As always, have a conversation with your banker / financial adviser to better understand which of or whether these products would be beneficial to your organisation, and aligned with your enterprise strategy.

Oxygen Consulting can assist with advisory services to help prepare a SLL, assurance of your SLL (or just the GHG emissions element of it), or independent verification of your SLL.